At NFT Droppers, we provide the latest crypto news, in-depth project information, and comprehensive market insights. Launched in 2022, our platform covers new token launches, market trends, and detailed reviews of crypto and NFT projects. We offer reliable ratings based on 70+ evaluation factors, including tokenomics, roadmaps, and team authenticity. Whether you’re an investor or a crypto enthusiast, NFT Droppers keeps you informed with accurate, up-to-date information and expert analysis.

How to Buy DAO Crypto: Decentralized Guide

Table of Contents

The crypto market’s a proper beast, and you’re knackered watching it roar past—Bitcoin’s smashing $96,000, Ethereum’s steady at $3,400—while you’re itching to get your hands on some Decentralized Autonomous Organization (DAO) crypto with your USD. You’re not here to faff about with centralised gatekeepers or overhyped rubbish. I’ve been in the blockchain trenches for years, slicing through the chaos to turn raw tech into moves any American punter can master. This isn’t a dodgy punt—it’s a full-on guide to buying DAO crypto in 2025, loaded with the latest data and a no-messin’ plan to get you into the $2.4 trillion scrap. The whales are cashing out, but you’re not stuck on the sidelines anymore. Let’s cut the noise and get you stacking DAO tokens like a pro.

DAOs are the real deal—blockchain outfits with no boss, just code and community running the show. Think MakerDAO’s MKR at $1,800, managing $6 billion in locked value, or Uniswap’s UNI at $8, steering a $4 billion DeFi giant, per CoinDesk. Over 5,000 DAOs hold $13 billion in treasuries, according to DeepDAO, with the market churning $2.8 billion daily. You’re buying governance—tokens like UNI, MKR, or AAVE ($155) give you a say in billion-dollar protocols. This isn’t just about profit; it’s your ticket to freedom in a $2.4 trillion warzone. This guide’s your battle plan—USD to decentralized power, step by step. Let’s dive in.

Why DAO Crypto’s Your Next Strike

Let’s cut the crap—why sink your USD into DAO tokens when BTC’s flexing at $96,000? It’s about control, mate. DAO crypto isn’t some speculative flutter—it’s your stake in the blockchain’s guts. Snag MKR, and you’re shaping MakerDAO’s $6 billion stablecoin empire. Grab UNI, and you’re steering Uniswap’s $4 billion swap machine. These aren’t meme coins—5,000+ DAOs run real systems, from DeFi titans like AAVE ($10 billion locked) to virtual worlds like Decentraland (MANA at $0.50). Governance tokens mean you’re not just a hodler; you’re a player. X chatter’s buzzing “DAOs are the future”—$13 billion in treasuries proves it.

The payoff’s proper. BTC’s up 5% weekly—$50 could hit $51 at $97,000—but DAO tokens bring more than price pops. UNI at $8? $50 gets 6.25 tokens; a climb to $9.60 nets $60—20% up. AAVE’s $155—$50 grabs 0.32 tokens, $165’s $52.80. Volatility’s brutal—17% drops aren’t rare—but DAOs tie to real value: $2.8 billion daily volume keeps it alive. You’re not chasing hype; you’re banking on blockchain’s steel spine. Centralised platforms can rug you; DAOs hand you the wheel. Time to get your kit sorted and strike.

What You’ll Need to Get Cracking

Buying DAO crypto isn’t a stroll—you need your gear ready to dodge the traps. Here’s the rundown:

- USD Funds: Cash in your bank—$10, $50, $100—your fuel for the fight.

- A Wallet: MetaMask, Trust—free, your crypto vault.

- An Exchange Account: Coinbase, Binance.US—your fiat bridge.

- ID Verification: License or passport—KYC’s a must, no shortcuts.

- A Plan: Pick your DAO—Maker, Uniswap—research first.

No tech wizardry, no secret handshake—just the basics to hit the ground running. We’ll break this into steps you can smash out without breaking a sweat.

Step 1: Pick Your DAO and Token

First move: choose your turf. DAOs aren’t all the same—MakerDAO’s MKR ($1,800) runs DAI’s $6 billion peg; Uniswap’s UNI ($8) swaps $4 billion; AAVE ($155) lends $10 billion. Fancy virtual land? MANA ($0.50) rules Decentraland. Each token’s a vote—MKR’s 977,000 supply, UNI’s 1 billion cap. DeepDAO tracks 5,000+ DAOs—$13 billion locked, real outfits. Coinbase has UNI, MKR; Binance.US adds AAVE. X says “UNI’s a steal”—$50 gets 6.25 UNI, governance in your pocket. Know your target—$50’s your stake.

Step 2: Set Up Your Wallet

Your wallet’s your fortress—MetaMask’s free, sorted in 10 minutes. Download it—browser or app—create a wallet, grab your 12-word seed phrase, stash it offline (paper, steel). Trust Wallet’s another shout—mobile, same drill. Tie it to Ethereum—most DAO tokens (UNI, MKR, AAVE) are ERC-20. X raves “MetaMask’s slick”—80 million users back it. No wallet, no control—exchanges hold your keys otherwise. $50 stays yours, not theirs. Done? Next up.

Step 3: Fund Your Exchange with USD

Wallet’s live—now load it up. Coinbase—30 million U.S. users—takes debit (2.99% fee) or ACH (free). $50 debit lands $48.51 after $1.49; ACH’s $50 flat, 1-3 days. Binance.US—0.5% fee—$50 nets $49.75 instant. “Settings,” “Payment Methods,” link your Visa or bank—five minutes. Kraken’s 3.75% bites—$1.87 on $50. X says “ACH’s your mate”—cheap if you’ve got time. Funds in? Dashboard ticks $50 USD—ammo’s ready.

Step 4: Buy Your DAO Crypto

Let’s pull the trigger. Coinbase—“Buy/Sell,” search UNI ($8), $50—6.25 tokens, $1.49 fee nets 6.06. Binance.US—“Markets,” AAVE ($155), $50—0.32 tokens, $0.25 fee leaves 0.319. Market order grabs it now—live price. Limit order? Set UNI at $7.80—snags if it dips. Confirm—seconds later, it’s yours. Portfolio shows 6.06 UNI—real skin in the game. Test $10—1.25 UNI—feel the rhythm. X whispers “limit’s sharp”—it is, for dips.

Step 5: Move It to Your Wallet

You’ve got crypto—lock it down. Exchanges hold it—Coinbase’s keys, not yours. “Send,” paste your MetaMask address (0x…), $50 UNI’s $0.50 gas fee, 10 minutes to land. Binance.US—same drill, $0.25 fee. AAVE’s pricier—$2 gas on $50. X swears “wallets beat hacks”—$35 million Crypto.com lost in 2022 proves it. For $50, exchange’s fine—$50,000 fraud cap covers you. Big stacks? Ledger Nano X, $150—offline steel. You’re the bank now.

Step 6: Join the DAO Game

Tokens in hand—wield them. Uniswap—connect MetaMask at app.uniswap.org, “Governance,” 6.06 UNI votes on $4 billion swaps. MakerDAO—oasis.app, MKR stakes DAI’s $6 billion peg. AAVE—aave.com, 0.319 tokens tweak $10 billion loans. Snapshot’s your ballot—proposals live, vote free. X says “voting’s power”—5,000+ DAOs run on it. No minimum—$50’s a voice. Delegate if you’re knackered—pass votes to pros. You’re not a bystander; you’re in the scrap.

Step 7: Track and Tweak

Buying’s the start—stay sharp. CoinGecko—UNI’s $8, MKR’s $1,800—live ticks. Alerts—$7.80 UNI dip, strike again. Weekly buys—$25, 3.125 UNI—smooths 17% swings. Gains? $50 to $60’s 20%—watch it. Sell? Back to Coinbase, $60 nets $58.51 after fees. X raves “DCA’s king”—$50 grows steady. You’re not guessing; you’re steering.

Other Ways to Grab DAO Crypto

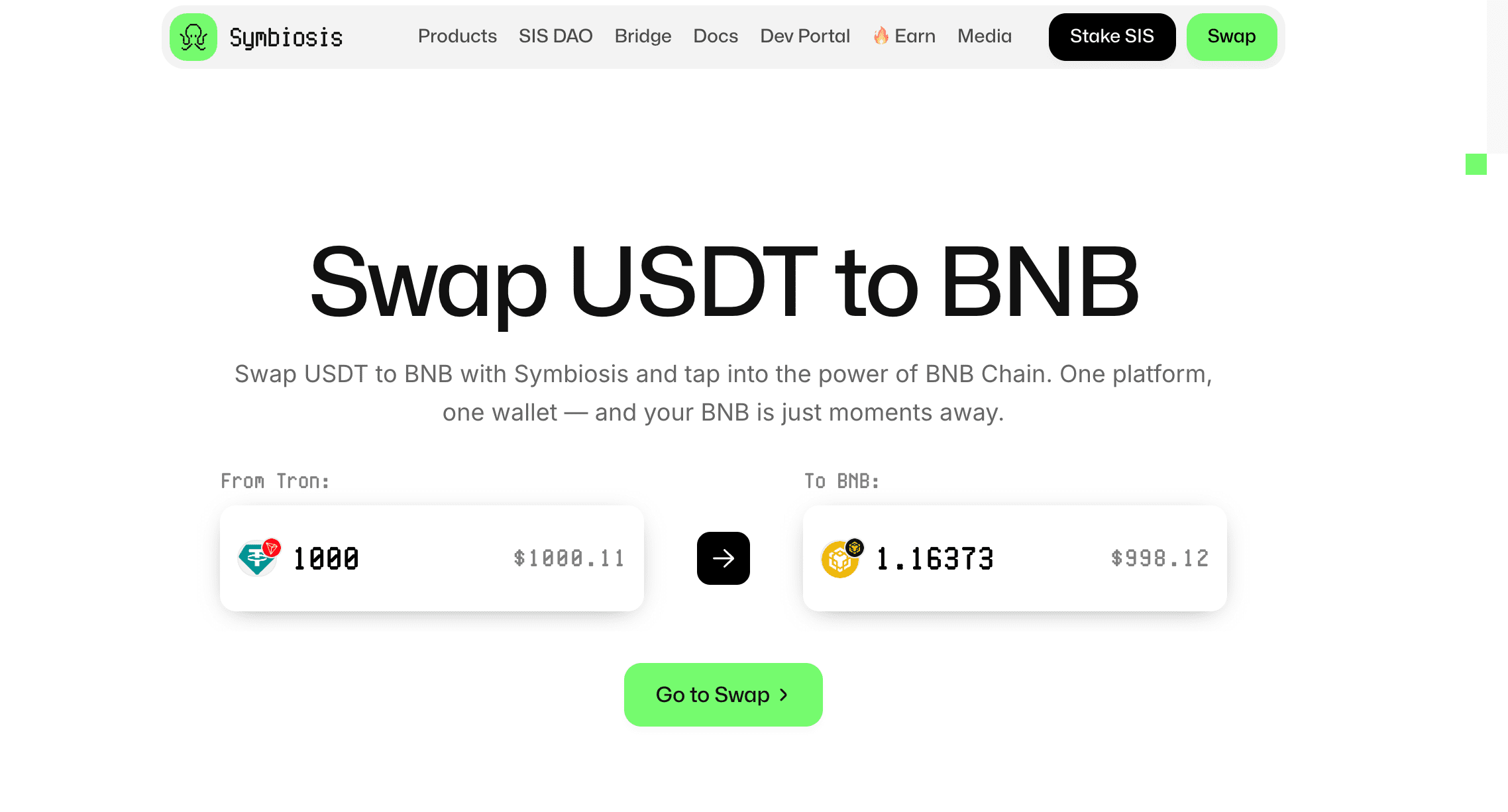

Exchanges not your vibe? DEXs—Uniswap, $50 ETH to 6.25 UNI, $1 gas. SushiSwap—AAVE, $50 for 0.31, $2 fee. P2P—LocalCryptos, $50 cash for MKR, 1% cut. Airdrops? Join DAOs early—Uniswap dropped $400 UNI in 2020. X says “DEXs rule”—no KYC, pure grit. Mix ‘em—$25 Coinbase, $25 Uniswap—for flexibility.

The Risks You Can’t Dodge

Crypto’s a warzone—DAOs don’t escape it. Fees bite—2.99% on Coinbase, $1.49 on $50. Gas? $0.50-$2 per move. Volatility’s savage—UNI’s $44 peak, now $8, 82% down. Hacks? The DAO lost $60 million in 2016—code’s only as tough as its weakest link. No FDIC—$50’s not insured, though Coinbase’s $50,000 cap helps. IRS claws 37% short-term gains—$0.07 on $0.19—per IRS.gov. Risk $50 you can burn—$5,000’s your life, guard it.

Latest Data: DAO Crypto in the Fight

Here’s the pulse. BTC’s $96,000, $1.9 trillion cap—5% up. ETH’s $3,400, $410 billion. UNI’s $8, $6 billion. MKR’s $1,800, $1.8 billion. AAVE’s $155, $2.3 billion. MANA’s $0.50, $900 million. Daily volume’s $2.8 billion—CoinDesk’s tally. Over 5,000 DAOs, $13 billion locked—DeepDAO. X screams “DAOs run it”—$2.4 trillion market says yes. Strike fast.

FAQs: Your Top Questions Sorted

Can I buy $10 worth? Yes—1.25 UNI on Coinbase, fees in.

Is DAO crypto safe? Solid—blockchain’s steel—but hacks hit.

What’s cheapest? Binance.US—0.5% vs. 2.99% Coinbase.

Can I vote with $50? Yep—6.06 UNI’s a voice, no minimum.

Will UNI hit $10? Maybe—20% weekly pumps say close, no promises.

Conclusion

You’ve got the playbook—buying DAO crypto’s your shot at the $2.4 trillion beast. Pick, wallet up, fund, buy, move, vote, track—seven steps turn $50 into 6.06 UNI or 0.027 MKR in USD. The market’s live—$2.8 billion daily, 5,000+ DAOs, $13 billion locked—and you’re not watching; you’re in the fight. Risks? Fees, crashes, taxman’s cut—real, but beatable. Rewards? Governance, gains—$50 to $60—if you’re sharp. This isn’t a flutter; it’s your strike. Grab your tokens, vote on the blockchain, and carve your chunk of the decentralized pie. Your USD’s ready—make it count.

Disclaimer: The information presented here may express the authors personal views and is based on prevailing market conditions. Please perform your own due diligence before investing in cryptocurrencies. Neither the author nor the publication holds responsibility for any financial losses sustained.

Top Crypto Presales

Ionix Chain $IONX

Ionix Chain $IONXBEST CRYPTO CASINO

TOP EXCHANGES

CRYPTO PAYMENT GATEWAY

Crypto Cloud

Crypto CloudBEST HARDWARE WALLET

Tangem

Tangem Gamdom

Gamdom Stake.com

Stake.com Coins.Game Casino

Coins.Game Casino